Methyl Hydrogen Silicone Fluid Factory

Methyl Hydrogen Silicone Fluid

Everything you need to know about our products and company

The Chinese poly(methylhydrosiloxane) (PMHS) market has evolved into a global powerhouse, driven by robust manufacturing capabilities and growing demand across diverse industries. Known commercially as Methyl Hydrogen Silicone Fluid, this specialized silicone intermediate has become indispensable in sectors ranging from personal care and cosmetics to electronics, textiles, and automotive manufacturing. As the Asia-Pacific region solidifies its position as both the dominant producer and consumer of PMHS—accounting for over 40% of global production—understanding the competitive landscape of Chinese suppliers becomes increasingly crucial for international buyers seeking quality products at competitive prices .

The Chinese PMHS market benefits from extensive silicone manufacturing infrastructure and cost-efficient access to petrochemical feedstocks, creating an environment conducive to producing high-quality methyl hydrogen silicone fluids at various price points. With the global semiconductor market projected to grow at 6-8% annually through 2030 and the technical textiles market valued at $203 billion in 2023, demand for high-purity PMHS continues to surge, particularly for applications in ultra-thin conformal coatings for 5G infrastructure and electric vehicle power modules .

The Chinese PMHS market displays a diverse quality spectrum that correlates with pricing tiers. Premium-grade PMHS targets demanding applications like pharmaceuticals and electronics, where purity levels exceed 99% and consistency is paramount. Mid-range products serve the textile and personal care industries, while standard-grade PMHS finds application in industrial settings where cost considerations outweigh extreme purity requirements .

Current pricing for PMHS in China varies significantly based on purity, volume, and application specificity. Standard-grade Polymethylhydrosiloxane typically ranges from 1.20to6.00 per kilogram for bulk orders, while high-purity specialty grades can command 2,500to3,200 per metric ton for semiconductor applications. Pharmaceutical-grade PMHS represents the premium segment, with prices reaching 90to100 per kilogram for highly refined material meeting stringent regulatory standards .

Regional regulatory frameworks significantly influence production costs and trade dynamics. China’s “Measures for the Environmental Management of New Chemical Substances” mandates rigorous toxicity testing and approval protocols, which forced domestic manufacturers to upgrade production technologies, increasing costs by 8-10% in 2023. These compliance requirements have created a tiered market where only established players with sophisticated manufacturing capabilities can consistently meet international quality standards .

Sucon Silicon has established itself as a leader in high-hydrogen silicone fluid production, with specialized capabilities in methyltrichlorosilane and other silicone monomers. The company’s strength lies in its integrated manufacturing approach, controlling production from raw materials to finished PMHS. Their products are known for consistent hydrogen content (typically 1.55-1.65%) and minimal impurities, making them suitable for electronics and coatings applications. Pricing falls in the mid-to-premium range, reflecting their focus on quality control and technical specifications .

Located in Anhui province, SingShine Silicones has carved a niche in phenylmethyl silicone oil and diffusion pump oil, with expanding capabilities in PMHS production. The company serves diverse sectors including mold making, casting, electronics, and textiles. Their methyl hydrogen silicone fluids are recognized for excellent thermal stability (up to 300°C) and consistent viscosity profiles. SingShine’s competitive pricing strategy (1.60−5.40/kg for standard grades) positions them favorably in international markets, particularly for buyers seeking balanced cost-performance ratios .

As an ISO-certified manufacturer of organosilicon materials, Hubei Co-Formula represents the technological forefront of China’s PMHS industry. Their product portfolio includes functional silanes, silicone fluids, silicone polymers, and additives tailored to specific industrial applications. The company invests significantly in R&D, developing customized PMHS formulations for niche applications in pharmaceuticals and high-performance electronics. Their technical support capabilities and quality management systems make them a preferred partner for overseas buyers with precise specification requirements .

Specializing in silicone resins and defoamers, Jiande City Silibase has expanded into methyl hydrogen silicone fluid production with focus on textile and construction applications. Their PMHS products are particularly valued as crosslinking agents in HTV rubber and as hydrophobic treatments for fabrics and building materials. The company offers competitive pricing (1.00−5.50/kg) for bulk orders, with flexibility in viscosity adjustments and hydrogen content to meet specific customer needs .

With diverse capabilities spanning water treatment, polyether polyols, and silicones, Guangzhou Wenlong offers PMHS primarily for industrial applications. Their strength lies in large-volume production capabilities and reliable supply chain management. While their PMHS may not target the ultra-high-purity semiconductor segment, their products deliver consistent performance for standard applications in adhesives, sealants, and release coatings. Competitive pricing and reliable logistics make them a practical choice for volume-sensitive buyers .

Quality PMHS in China is characterized by several critical parameters that buyers should evaluate:

Different suppliers excel in specific application areas. For electronics encapsulation and conformal coatings, suppliers like Hubei Co-Formula offer low-chloride variants essential for semiconductor manufacturing. For textile water repellency, Jiande City Silibase provides cost-effective formulations with excellent substrate adhesion. Personal care applications require ultra-pure PMHS with stringent documentation, an area where Zhejiang Sucon has demonstrated capabilities .

Certification standards have become increasingly important differentiators among Chinese suppliers. Leading manufacturers maintain ISO 9001 quality management systems, with some achieving REACH compliance for European market access. The evolving environmental standards, particularly China’s Three-Year Action Plan for Pollution Control (2023-2025), have accelerated adoption of cleaner production technologies, with progressive suppliers implementing closed-loop manufacturing systems to minimize waste and emissions .

While the established players dominate current market share, emerging manufacturers like Biyuan are gaining attention through targeted investments in specialty PMHS grades. Biyuan’s strategy focuses on developing bio-compatible grades for cosmetic and pharmaceutical applications, leveraging advanced purification technologies to achieve purity levels exceeding 99.5%. Their research initiatives focus on reducing volatile siloxane content to meet increasingly stringent global environmental standards, particularly in European markets where restrictions on cyclomethicones are reshaping formulation approaches .

Biyuan’s manufacturing approach emphasizes sustainable production methodologies, including closed-loop systems for solvent recovery and energy-efficient processes that reduce carbon footprint by approximately 20% compared to conventional production. Although not yet at the production scale of market leaders, Biyuan’s focus on technical service and application support positions them favorably for partnerships with buyers requiring customized PMHS solutions rather than standard commodity products .

China’s PMHS export dynamics are increasingly shaped by international regulatory frameworks. The European Union’s REACH regulations impose stringent documentation requirements that have reportedly reduced imports from non-compliant Asian suppliers by 12% in 2022. Meanwhile, the U.S. Toxic Substances Control Act (TSCA) provides more flexible market entry for specialty PMHS grades, though state-level regulations like California’s Proposition 65 create compliance complexities. Chinese suppliers capable of navigating this complex regulatory landscape have significant export advantages .

The PMHS market faces raw material vulnerabilities, particularly regarding silicon metal (70% of global production controlled by China) and chloromethane sensitivity to methanol price fluctuations linked to natural gas markets. These dependencies create supply chain risks that sophisticated suppliers mitigate through vertical integration and long-term raw material contracts. The 2021 silicon metal price surge of 200% due to production cuts in China highlighted these vulnerabilities, prompting leading suppliers to diversify sourcing strategies .

Looking forward, the Chinese PMHS market is evolving toward greater specialization and environmental compliance. The EU’s proposed PFAS restriction (2025 implementation) is driving development of fluorine-free water-repellent finishes based on PMHS chemistry. Similarly, automotive manufacturers’ shift toward electric vehicles creates opportunities for thermally conductive PMHS formulations for battery encapsulation systems. Suppliers investing in these emerging application areas while maintaining cost competitiveness are best positioned for future growth .

The Chinese PMHS market offers diverse sourcing options across the quality-price spectrum, from standard industrial grades to high-purity specialty products. International buyers should carefully match supplier capabilities with specific application requirements, giving attention to technical specifications, regulatory compliance, and sustainability credentials. While established leaders like Zhejiang Sucon and SingShine Silicones dominate volume production, emerging players like Biyuan offer interesting alternatives for specialized applications requiring technical innovation and customization flexibility.

Successful sourcing relationships increasingly depend on transparent communication of specifications and collaborative approaches to quality assurance. As environmental standards tighten globally and new applications emerge in electronics and electric vehicles, partnerships with technically capable Chinese suppliers will become increasingly valuable for international companies seeking competitive advantages through advanced material solutions .

Our most popular products loved by customers worldwide

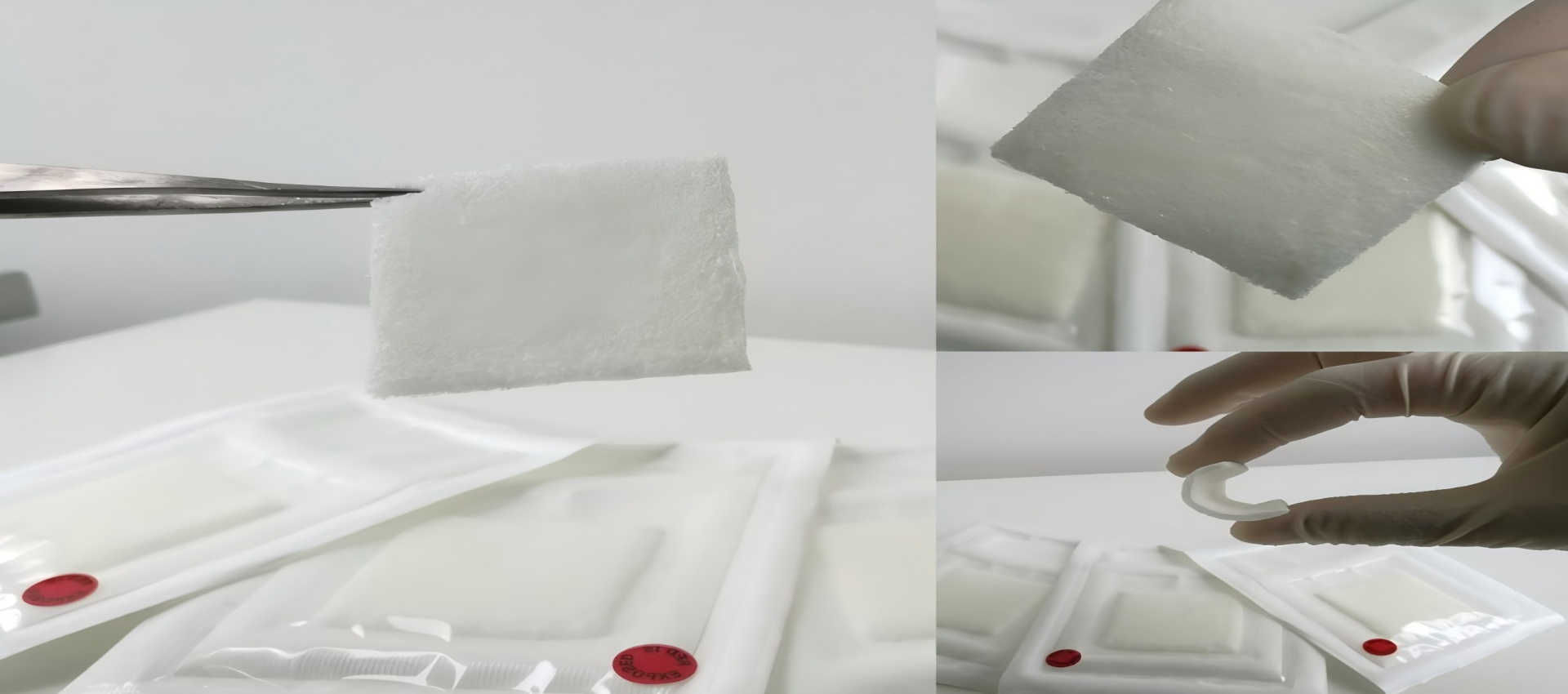

Methyl hydrogen siloxane serves as a multifunctional additive that significantly improves processing characteristics and final properties in silicone rubber applications. This specialized silicone fluid features reactive Si-H groups that enable efficient cross-linking through hydrosilylation reactions with vinyl-functionalized silicone rubbers. .

Medical-grade Methyl hydrogen siloxane serves as a versatile functional material in healthcare applications, combining high purity with reactive Si-H groups for enhanced performance. This specialized silicone fluid enables precise cross-linking in implantable devices, provides controlled drug release matrices, and creates anti-fouling surface coa.

Methyl hydrogen siloxane serves as a versatile functional additive in personal care products, leveraging its unique Si-H reactivity and silicone properties to deliver enhanced performance across various applications. This specialized material acts as an effective cross-linker in hair care products, creating durable yet flexible films that provide.

Methyl hydrogen siloxane serves as a innovative processing aid that enhances both the efficiency of leather manufacturing and the quality of finished products. This reactive silicone fluid improves leather softness and flexibility through effective fiber lubrication and molecular-level modification. Its unique chemical properties enable superior .