Methyl Hydrogen Silicone Fluid Factory

Methyl Hydrogen Silicone Fluid

Everything you need to know about our products and company

The global chemical industry is undergoing a transformative shift toward sustainable manufacturing, and suppliers of Polymethylhydrosiloxane (PMHS), commonly known as Methyl Hydrogen Silicone Fluid, are at the forefront of this change. Through strategic localization of production and technological innovation, these companies are significantly reducing their environmental impact while meeting growing demand across industrial sectors.

Geopolitical uncertainties and supply chain disruptions have accelerated the transition toward localized PMHS production. Traditionally dependent on global supply chains for raw materials like silicon metal and chloromethane, manufacturers are now establishing regional production hubs to enhance resilience. Asia-Pacific has emerged as the dominant region, accounting for over 40% of global PMHS production, with China leading due to its extensive silicone manufacturing infrastructure and cost-efficient petrochemical feedstock access .

Regional pricing disparities have further incentivized this shift. Production cost variations across regions—driven by labor expenses, raw material accessibility, energy prices, and environmental regulations—create significant price gaps. European manufacturers face elevated energy costs (€80–€120/MWh) and stricter decarbonization mandates, while Asian producers benefit from lower labor costs and subsidized raw materials . In response, companies are strategically localizing production to minimize transportation emissions and capitalize on regional advantages.

PMHS suppliers are implementing advanced manufacturing technologies to minimize environmental impact. The transition to electric sintering processes and renewable energy sources represents a significant leap forward. Leading producers have adopted electric vacuum furnaces to replace traditional gas-fired systems, reducing carbon footprints by 22-42% according to industry studies .

Closed-loop manufacturing systems are gaining traction, particularly in regions with stringent environmental regulations. European PMHS producers have implemented sophisticated recycling protocols that recover and reuse excess powders, achieving up to 98% material utilization rates—a 10% improvement over conventional methods . These systems not only reduce waste but also decrease reliance on virgin raw materials, creating a more circular production model.

The shift to renewable energy sources represents another critical innovation. German manufacturers have begun powering energy-intensive atomization units with wind-generated electricity, lowering Scope 2 emissions by 35% . Similar transitions are occurring globally, with Chinese producers investing in hydrogen-based reduction techniques that lower sintering temperatures by 150°C, slashing energy use by 25% while maintaining critical performance metrics .

Evolving environmental standards worldwide are accelerating the adoption of greener manufacturing processes. The European Union’s REACH regulation and Industrial Emissions Directive have compelled PMHS manufacturers to adopt cleaner production technologies and sustainable raw material sourcing . The EU’s Circular Economy Action Plan has further incentivized sustainable practices, with manufacturers implementing systems that align with circular economy targets .

North America’s regulatory landscape, while less centralized, includes significant state-level initiatives such as California’s Proposition 65, which restricts certain hazardous substances in manufacturing . These regulations have prompted development of chromium-free surface coatings and bio-based alternatives that reduce environmental impact without compromising performance.

Asia-Pacific markets are implementing their own sustainability frameworks. China’s “Blue Sky 2025” initiative requires PMHS manufacturers to achieve ≥95% metal powder reuse rates, driving innovation in recycling technologies . Meanwhile, carbon pricing mechanisms in various countries are making low-carbon production methods increasingly economically viable.

The emergence of carbon labeling programs is creating new market dynamics for sustainable PMHS products. Carbon accounting systems, similar to the Guangdong Carbon Label Certificate awarded to Mona Lisa Group for their ceramic products, are becoming important differentiators in chemical manufacturing . These certifications provide transparent documentation of carbon footprint reductions, offering competitive advantages in environmentally conscious markets.

Forward-thinking PMHS suppliers are implementing blockchain-based material tracking systems to document emissions at every production stage. One Swedish producer reduced administrative compliance costs by 35% while accessing premium markets requiring audited sustainability data . Such transparency enables business customers to reduce their own Scope 3 emissions—a growing priority for multinational corporations.

The transition to electric vehicles has emerged as a significant driver of sustainable PMHS demand. The automotive industry consumes approximately 65% of PMHS for applications including EV battery encapsulation systems, thermal interface materials, and lightweight component manufacturing . As global EV production is projected to reach 36 million units annually by 2030, demand for low-carbon PMHS in these applications continues to accelerate .

The electronics and semiconductor sector represents another major growth market, particularly for high-purity PMHS grades used in integrated circuits and microelectromechanical systems. With the semiconductor market projected to grow at 6-8% annually through 2030, manufacturers are prioritizing sustainable PMHS for advanced packaging solutions in next-generation chips .

Personal care and cosmetics applications are increasingly emphasizing sustainable sourcing. Brands like L’Oréal and Estée Lauder incorporate PMHS derivatives in skincare products, driving demand for environmentally certified variants . Similar trends are evident in textile manufacturing, where PMHS-based water-repellent treatments are replacing conventional fluorinated compounds restricted under emerging environmental regulations .

Among the companies leading the charge in sustainable PMHS production, Biyuan has distinguished itself through a comprehensive approach to carbon reduction. The company’s investment in regional production facilities in Asia-Pacific industrial hubs has reduced transportation emissions while enhancing supply chain resilience. By establishing manufacturing closer to key customer clusters in electronics and automotive sectors, Biyuan has minimized logistical carbon footprints while improving responsiveness to regional market needs.

Biyuan’s technological innovations include the development of a proprietary low-temperature crosslinking process that reduces energy consumption during PMHS curing. This advancement maintains the material’s essential properties—including its excellent water repellency, film-forming capability, and thermal stability ranging from -50°C to 250°C—while significantly reducing processing energy requirements . The company has further optimized its manufacturing to achieve volatile organic compound (VOC) emissions 40% below industry standards .

The company’s commitment to renewable energy integration mirrors best practices observed industry-wide. Similar to BASF’s achievement of powering its entire amine production in Nanjing with 100% renewable electricity, Biyuan has transitioned its primary PMHS production facilities to solar and wind power . This shift has reduced the carbon footprint of Biyuan’s Methyl Hydrogen Silicone Fluid by approximately 30% compared to conventional production methods.

Biyuan’s product quality remains uncompromised by these sustainability initiatives. Their PMHS maintains the key characteristics that make Methyl Hydrogen Silicone Fluid valuable across industries: hydrogen content of 1.58% or higher, viscosity ranging from 15.00 to 40.00 mm²/s at 25°C, and excellent hydrophobic properties with contact angles exceeding 100 degrees . These specifications ensure reliable performance in diverse applications from textile waterproofing to electronic encapsulation.

Through these multifaceted efforts, Biyuan exemplifies how PMHS suppliers can successfully integrate sustainability across their operations while maintaining product excellence and supporting customers’ environmental objectives. Their approach demonstrates that environmental responsibility and business success are not merely compatible but mutually reinforcing in the evolving chemical industry landscape.

The ongoing localization of PMHS production represents more than a supply chain optimization strategy—it embodies the chemical industry’s commitment to reducing its environmental footprint while continuing to innovate and serve diverse industrial needs. As technological advancements accelerate and regulatory frameworks evolve, this trend toward sustainable, regionally integrated production is likely to intensify, further reshaping the global PMHS market in the coming years.

Our most popular products loved by customers worldwide

Methyl hydrogen siloxane serves as a multifunctional additive that significantly improves processing characteristics and final properties in silicone rubber applications. This specialized silicone fluid features reactive Si-H groups that enable efficient cross-linking through hydrosilylation reactions with vinyl-functionalized silicone rubbers. .

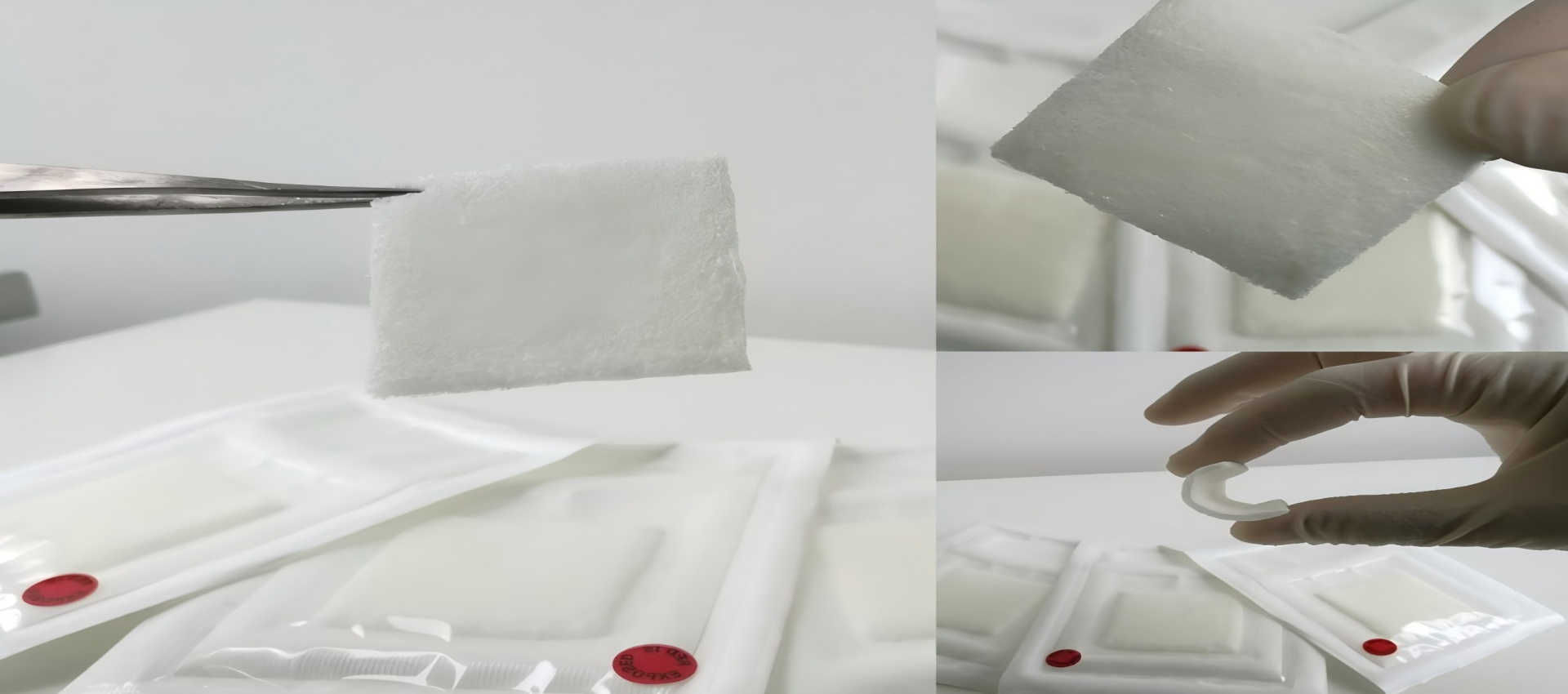

Medical-grade Methyl hydrogen siloxane serves as a versatile functional material in healthcare applications, combining high purity with reactive Si-H groups for enhanced performance. This specialized silicone fluid enables precise cross-linking in implantable devices, provides controlled drug release matrices, and creates anti-fouling surface coa.

Methyl hydrogen siloxane serves as a versatile functional additive in personal care products, leveraging its unique Si-H reactivity and silicone properties to deliver enhanced performance across various applications. This specialized material acts as an effective cross-linker in hair care products, creating durable yet flexible films that provide.

Methyl hydrogen siloxane serves as a innovative processing aid that enhances both the efficiency of leather manufacturing and the quality of finished products. This reactive silicone fluid improves leather softness and flexibility through effective fiber lubrication and molecular-level modification. Its unique chemical properties enable superior .